Valuable Real Estate Insights

Given what we read and see about inflation and recession, both in the US and globally, a number of our clients have expressed concern over a possible market correction and have asked if it is prudent to wait to buy after a correction.

Vikki and I just came back from Anaheim, CA for Keller Williams’ annual real estate event and we are excited to share thoughts from some of the top thought-leaders in real estate. This includes the work of an economist who spends every day looking and analyzing trends from a global and industry perspective.

They would suggest not to wait to buy real estate and here is why:

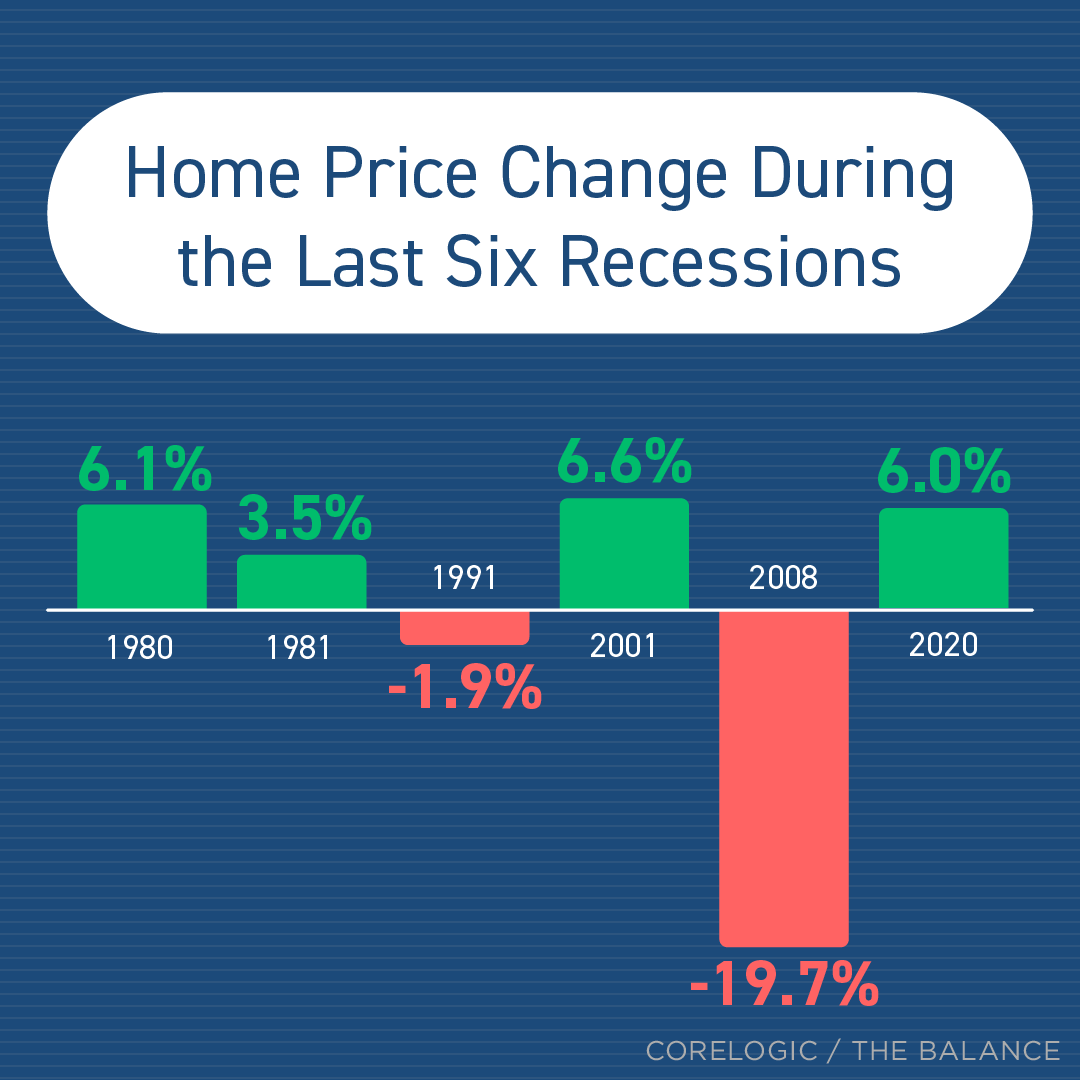

Real Estate continues to serve as a solid investment, even during a recession. Values appreciated in 4 out of the last 6 recessions.

Home Prices have risen every year for the past decade. We are expecting only a slight decrease in home prices in 2023, certainly not a correction.

Prices continue to remain stable in large measure because there are so few homes for sale (supply and demand). Six months of supply represents a balanced market and we have less than 3.

Our economists believe inflation has peaked and will continue to trend downward over the next two years toward the targeted 2%.

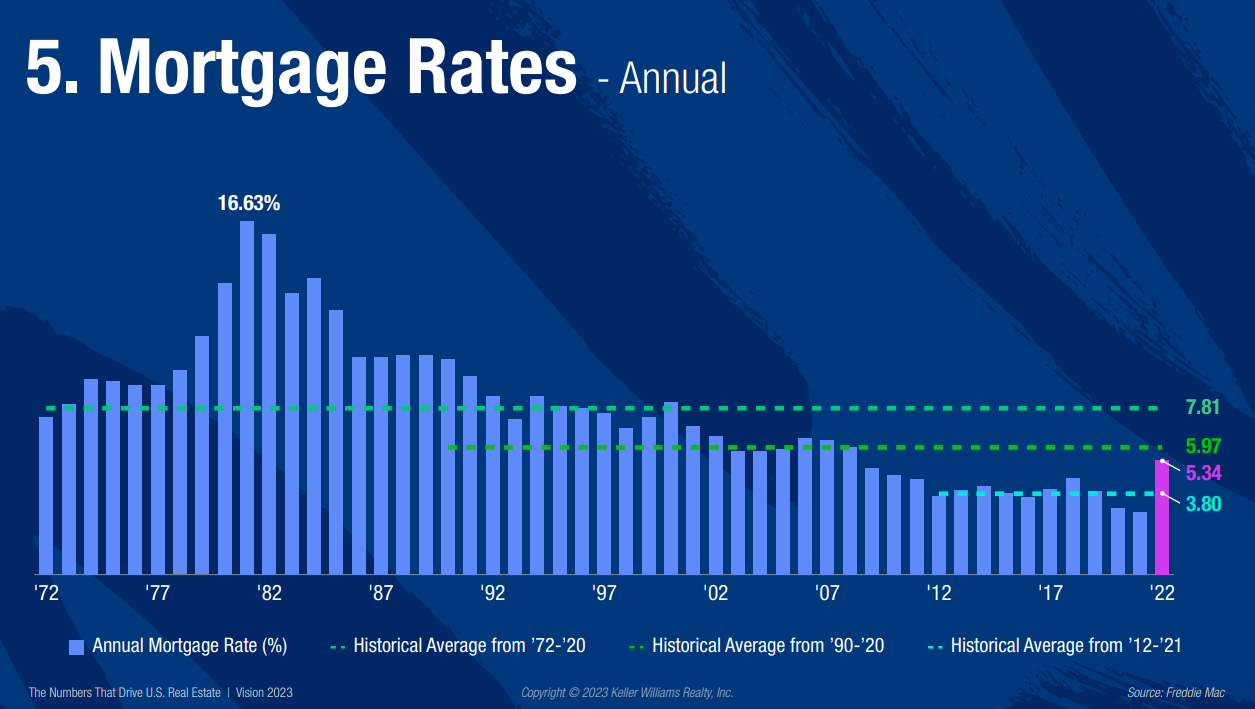

Mortgage rates, while significantly higher than the last two years, are still well below historical averages.

After just 3 years, clients are better off buying versus renting. After 7 years they have doubled their investment and continue to build wealth every year.