2024 Market Insights From Top Thought-Leaders in Real Estate.

2024 Real Estate Market – Insights at from Industry Leaders

Headlines have been filled with discussions of inflationary pressures and whispers of recession, both domestically and globally. However, experts assert that such concerns are unwarranted when it comes to the resilience of the real estate market.

Understandably, many of our clients have voiced concerns about the possibility of a market correction and whether it's wise to wait for it before making a real estate decision. As seasoned real estate professionals, Vikki and I recently had the privilege of attending the Keller Williams’ annual real estate event in Las Vegas, where we gained invaluable insights from some of the most respected thought leaders in the industry. Among them was an esteemed economist who dedicates every day to analyzing trends from a global and industry perspective.

What emerged from our experience was a unanimous stance: waiting for a market correction may not be the prudent strategy, and here's why.

Reflecting on the expert projections from the event, it's evident that the consensus is to proceed with confidence in the current real estate market. Despite the uncertainties looming in the broader economic sphere, real estate continues to demonstrate resilience as a tangible asset with the potential for long-term growth.

If you received our outlook this time last year, you will notice a similar start; with the benefit of 2023 in the rearview mirror, last year’s projections proved to be quite accurate.. This serves as a testament to the reliability of informed analysis and underscores the importance of basing investment decisions on sound research rather than speculation.

We have outlined below the main factors that support this projection.

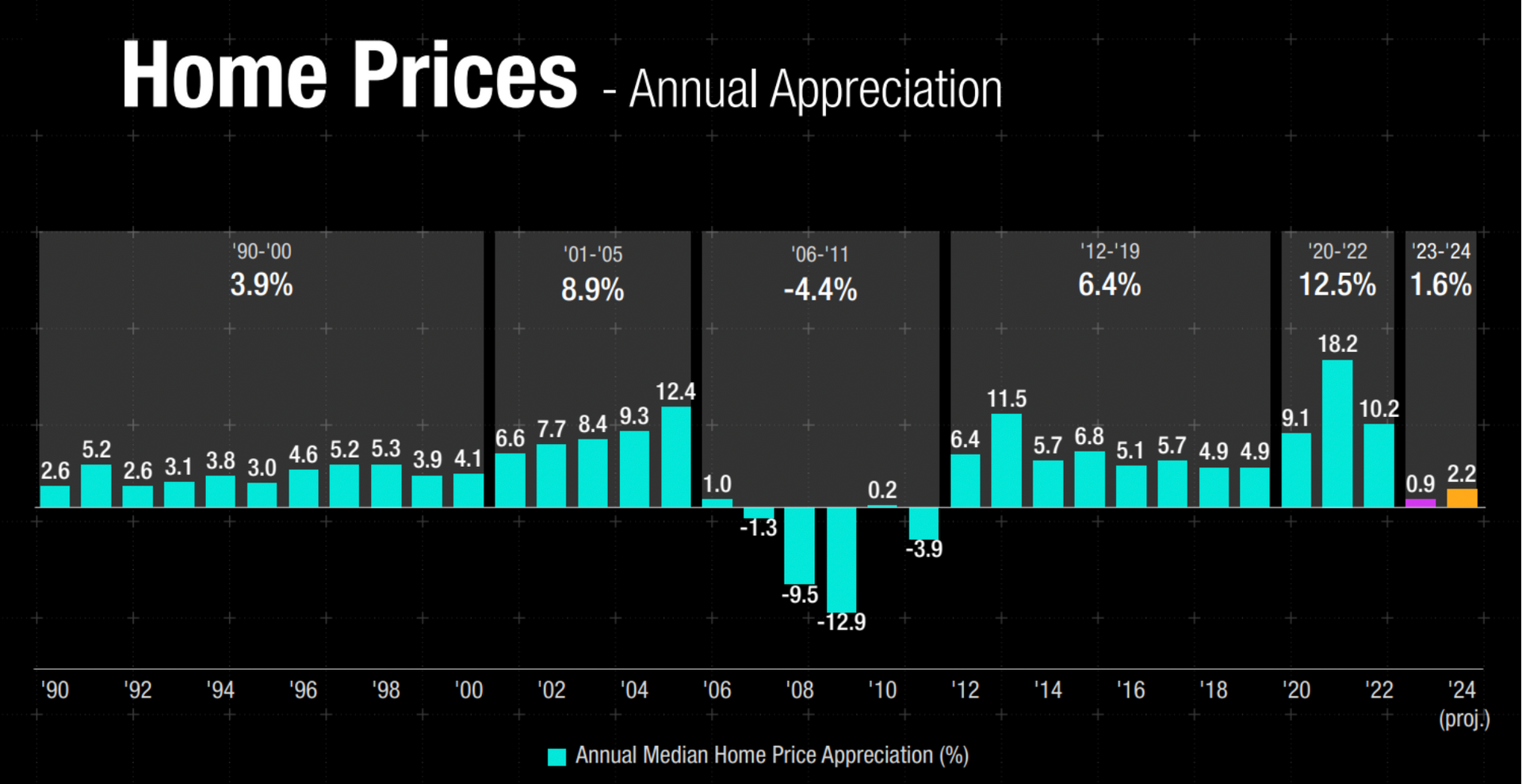

Home Prices have risen every year for the past decade. We saw a slight increase in home prices last year, despite the gloomy outlook, and expect a modest increase in 2024.

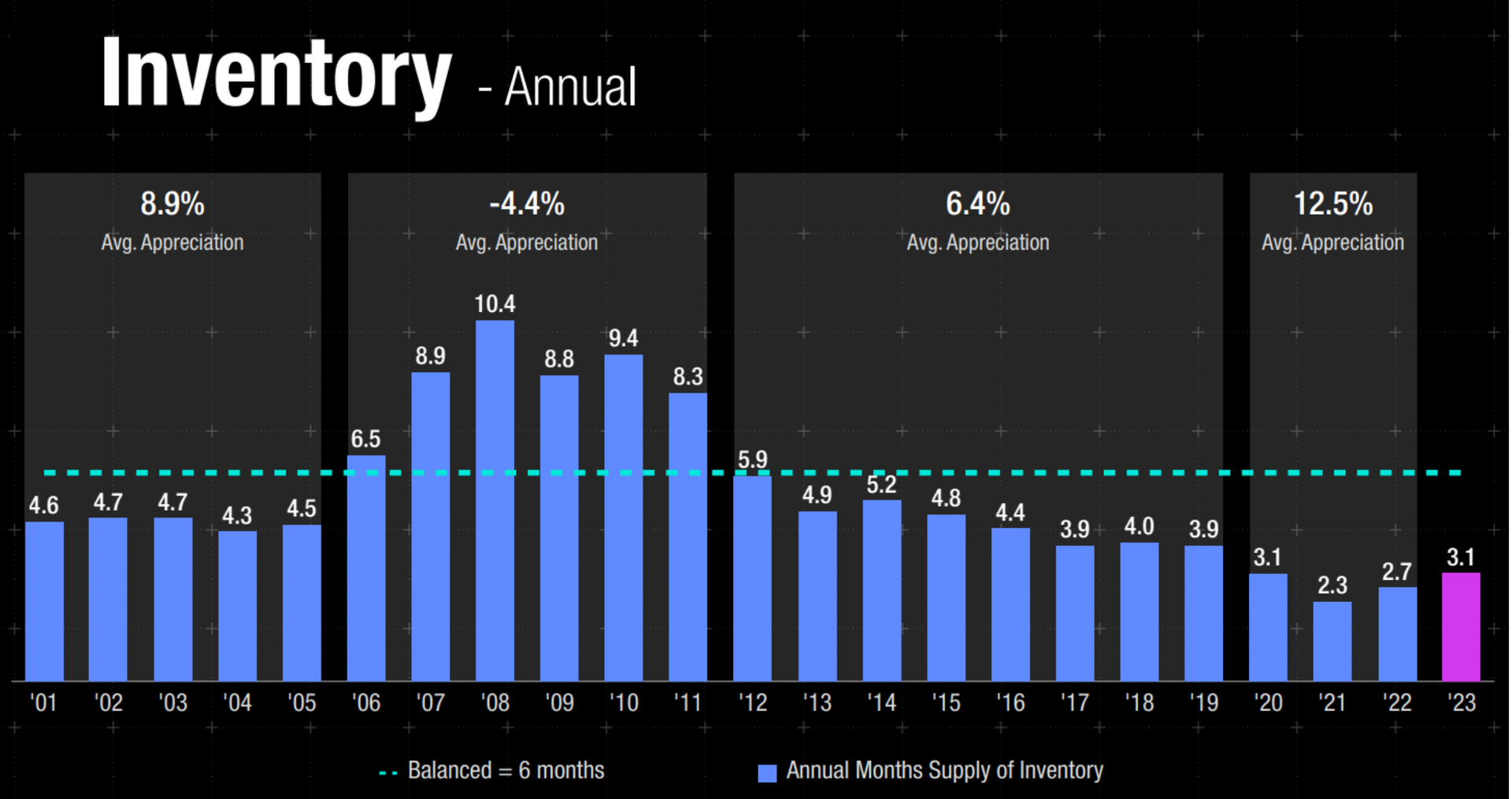

Prices continue to remain stable in large measure because there are so few homes for sale (supply and demand). Six months of supply represents a balanced market and we have around 3, same as last year.

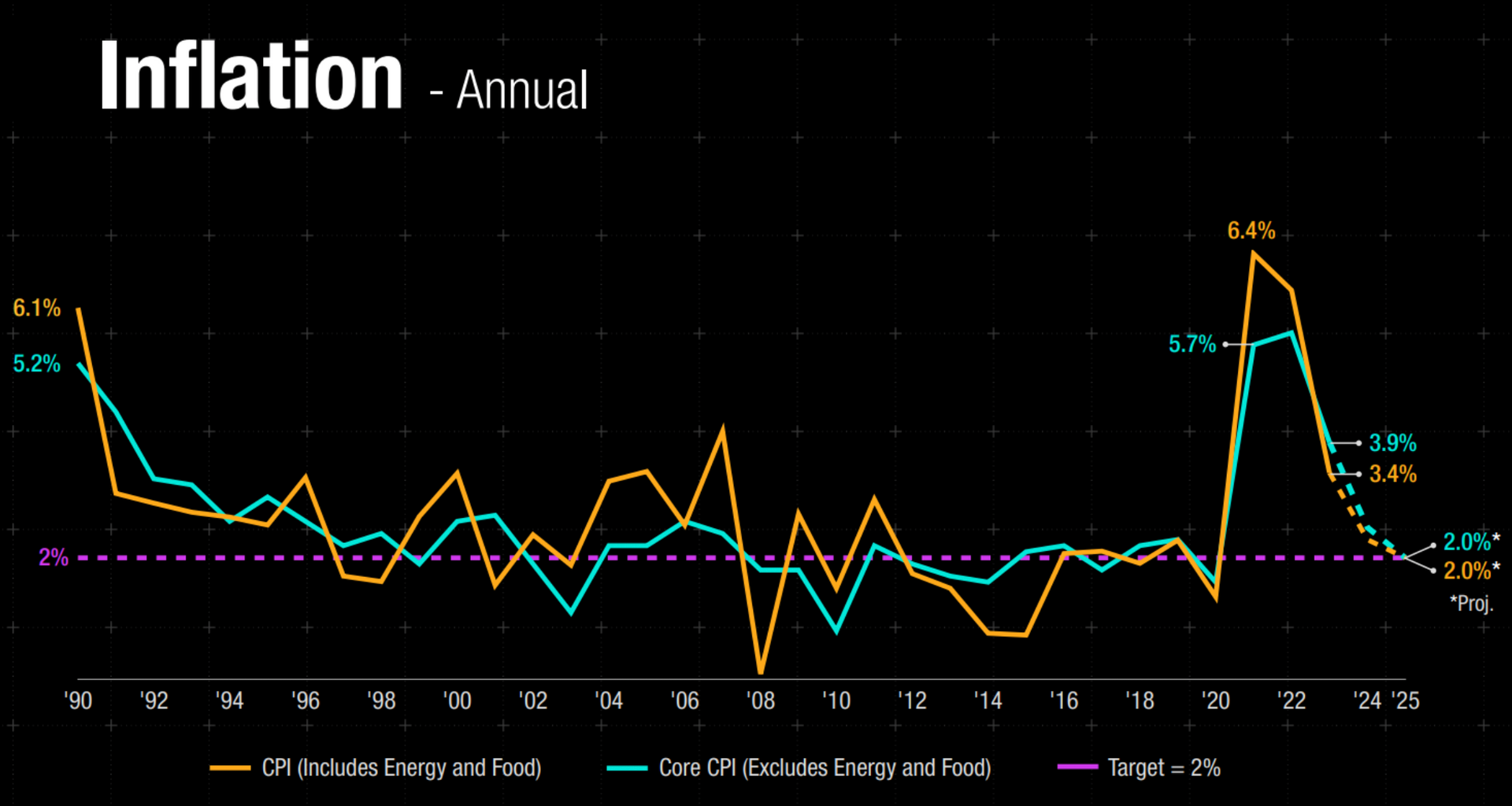

Our economists continue to believe inflation has peaked and will continue to trend downward toward the targeted 2%New Paragraph

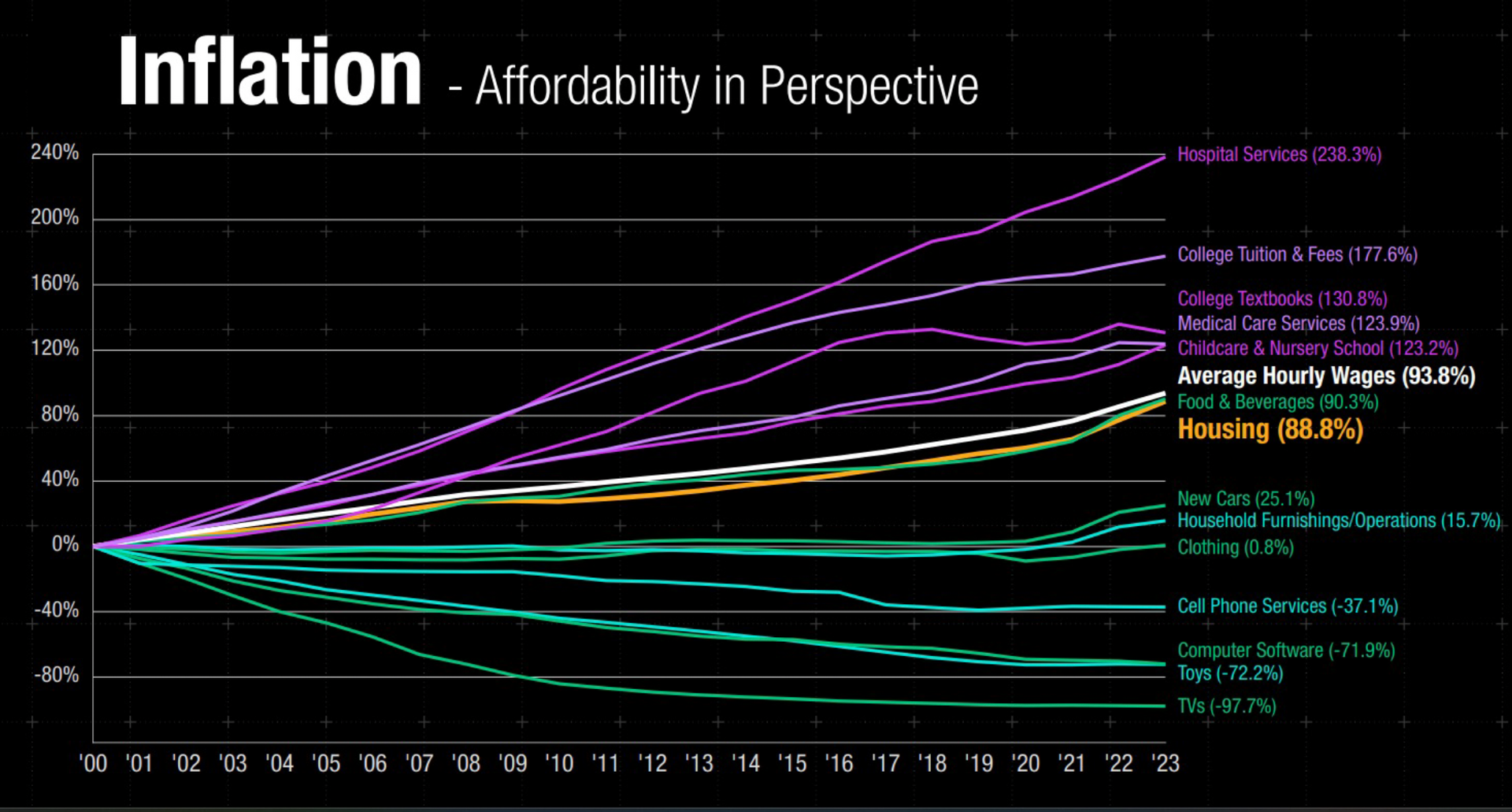

Increases in Medical Costs, College Costs and Childcare Costs are the drivers of inflation in the economy today

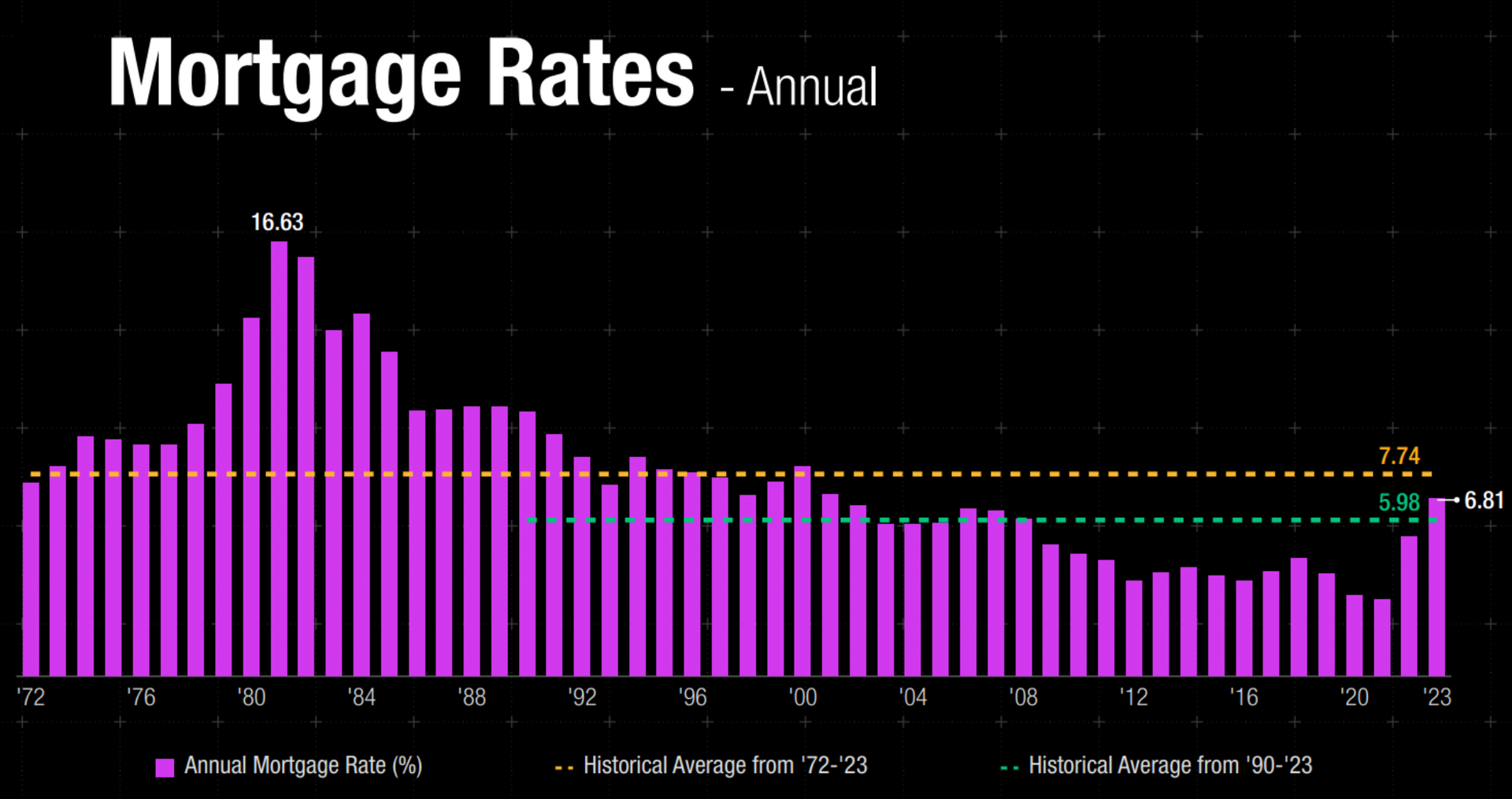

Mortgage rates, while significantly higher than the last two years, are still on par with historical averages.

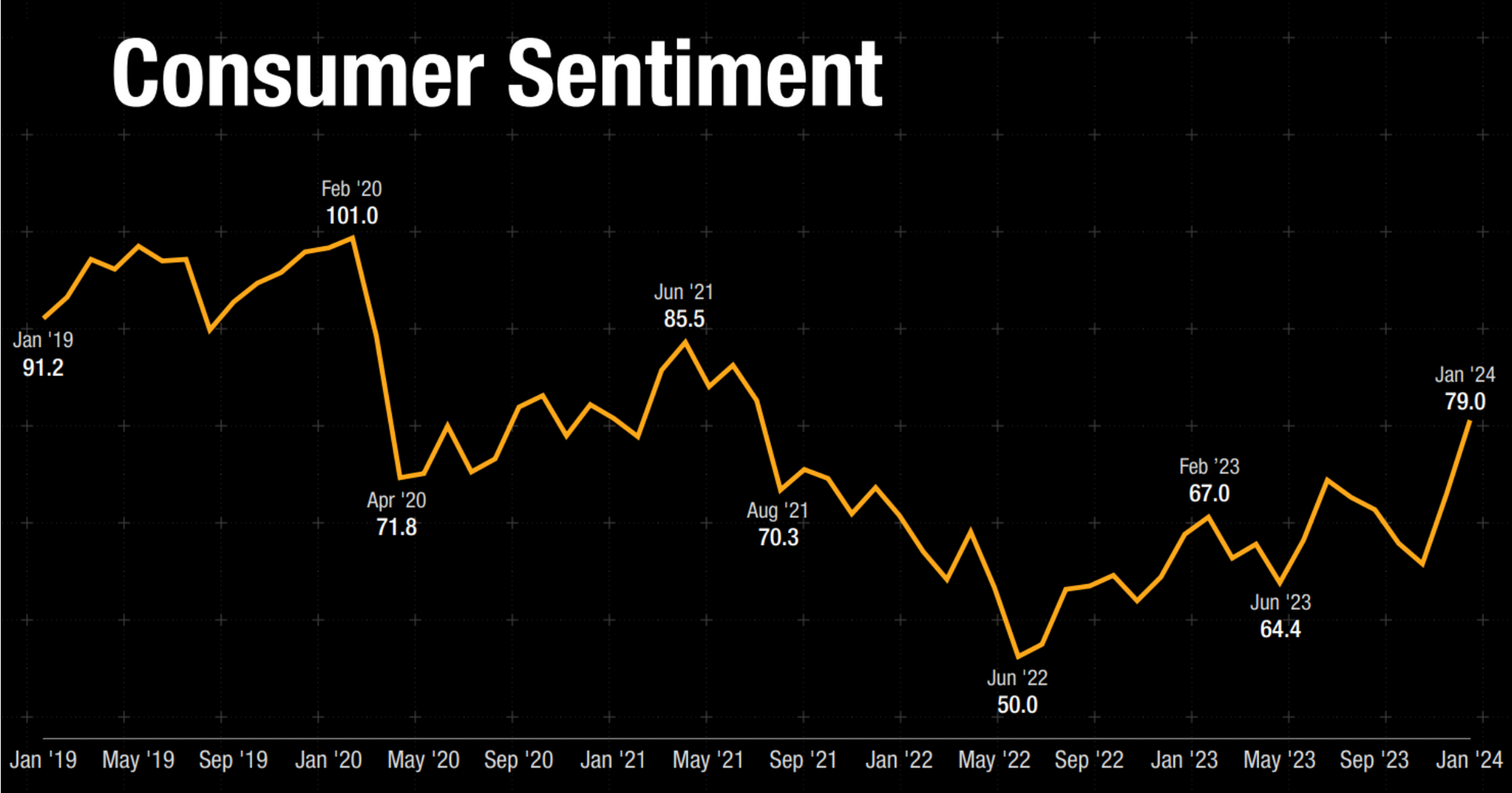

Consumers are expressing a growing confidence in the economy.

In conclusion, Vikki and I urge our clients to approach the real estate market with confidence and a strategic mindset. Rather than waiting on the sidelines for elusive market corrections, seize the opportunities that abound in the present moment. By leveraging the insights from industry leaders and economists alike, you can position yourself to capitalize on the inherent potential of the real estate market in 2024 and beyond.